The 91st General Assembly gaveled in on Monday to start the 2026 Iowa legislative session. The first week included speeches from party leaders, Governor Reynolds, Chief Justice Christensen, and Adjutant General Osborn, along with a flurry of bill introductions. These speeches included many anticipated major topics for this session, including property tax reform, eminent domain, cancer research and funding, economic growth and prosperity, and the state budget deficit.

The full text of each leadership address can be found below:

- Speaker Pat Grassley

- Majority Leader Bobby Kaufmann

- Minority Leader Brian Meyer

- Senate President Amy Sinclair

- Majority Leader Mike Klimesh

- Democratic Leader Janice Weiner

After the special elections in 2025, the Republican Party returned to the golden dome with a slightly smaller majority in the Senate (33-17) and no longer holds a supermajority in the chamber. The balance of the Iowa House of Representatives remained the same with 67 Republicans and 33 Democrats.

Governor Reynolds’ Condition of the State

On Tuesday, Governor Reynolds delivered her ninth Condition of the State ahead of her final year as governor of Iowa. Governor Reynolds opened by acknowledging the losses experienced by Iowa in 2025, including the passing of Senator Rocky DeWitt, Senator Claire Celsi, Representative Martin Graber, former Representative Janet Metcalf, and the two Iowan soldiers killed in Syria—Staff Sgt. Edgar Brian Torres-Tovar and Staff Sgt. William Nathanial Howard.

The Governor highlighted Iowa’s strong condition and released her Vision for Iowa along with her state budget recommendations, noting her top priorities:

- Delivering property tax relief

- Creating a healthier Iowa

- Expanding educational freedom

- Keeping Iowa’s farms in the family

- Serving Iowans who served us

- Preserving public safety

To carry out these priorities, Governor Reynolds shared her plans to:

- Modernize incentive systems to provide veteran benefits to counties based on outcomes and performance.

- Address property tax concerns by:

- Capping overall revenue growth on local governments.

- Moving the assessment schedule from every two years to every three years.

- Freezing property tax bills for seniors 65 and up who live in homes valued more than $350K.

- Create a tax-deductible savings account for first-time home buyers based on Iowa’s 529 savings program.

- Modernize the Beginning Farmer Tax Credit to include land sales.

- Utilize artificial intelligence to improve state programs.

- Reduce cost of government by expanding collaboration at the local level.

- Invest $50 million for cancer prevention, screening, and treatment via Healthy Hometown.

- Developing cancer care hub-and-spoke models, expanding this model to cardiovascular care, and mental health treatment.

- Promote healthy behaviors, including:

- Assisting low-income families with purchasing healthy foods, emphasizing a nutrition-first focus, and extending the federal SNAP waiver.

- Requiring a nutrition-focused CME for physicians.

- Removing artificial food dyes and additives from school foods.

- Ensure Per-Pupil funding follows the student, no matter which public school the student attends.

- Allowing concurrent enrollment of college credit courses to charter school students.

The entire Condition of the State may be accessed here. A complete guide to the Iowa Budget Report for FY 2027 can be found here.

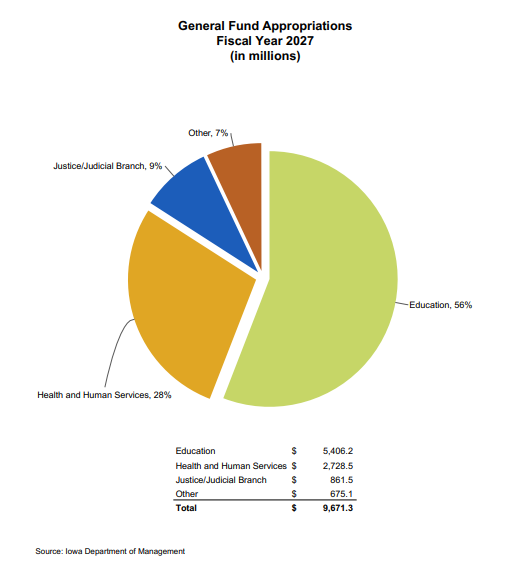

Using the projections from the December meeting of the Revenue Estimating Conference, the Governor released her General Fund Appropriations proposal for FY 2027, which are as follows:

The Iowa PBS broadcast included a Democrat response immediately following the Condition of the State, with House Minority Leader Brian Meyer to providing comments on the speech. The Minority Leader disagreed with the statement that the condition of the state is strong and cited Iowa’s poor national rankings in economic growth and income, stating that the state budget is heading toward a “fiscal death spiral.”

Iowa Property Tax Legislation and New Transparency Dashboard

The Senate and Governor released their long-anticipated property tax legislation during the first week of session. The Senate’s property tax bill, SSB 3001, and the Governor’s bill, SSB 3034, both limit the growth of local government property taxes to about 2% a year, although the bills use slightly different calculations for the limit. Some of the major differences between the bills are that the Senate bill eliminates the rollback, reforms the homestead credit into an exemption, and provides an optional sales tax increase while the Governor’s bill keeps the rollback, changes assessments to every three years, includes major TIF reform, and creates a FirstHome Iowa Account program.

The Governor’s bill also removes the election of County Treasurer/Auditor/ and Recorder moving those roles into appointed positions. The House is expected to release its major property tax bill also, and the chambers and Governor will then begin the work of hammering out what the final property tax legislation will look like in 2026.

During the Condition of the State, Governor Reynolds announced the launch of a new statewide Property Tax Dashboard. The dashboard is an interactive, public-facing tool designed to increase transparency around Iowa’s property tax system by showing how property taxes are generated and distributed across local governments.

The administration has framed the dashboard as a data foundation for upcoming property tax reform discussions, allowing policymakers, stakeholders, and taxpayers to better understand current trends, local impacts, and drivers of property tax growth. The dashboard is available here.

Condition of the Iowa Judiciary and Condition of the National Guard

On Wednesday, Chief Justice Susan Christensen delivered her Condition of the Judiciary. Each year she chooses a theme, and this year’s theme is leadership. The Chief Justice discussed the Judicial Branch’s comprehensive study of class and compensation to fix salary issues within the court system and the subsequent increase in applications for positions within the branch. In the next year, Chief Justice Christensen urged the state to modernize the magistrate system and to increase pay for judges and contract attorneys for indigent defense.

Major General Stephen E. Osborn, Adjutant General of the Iowa National Guard, delivered the 2026 Condition of the Guard on Thursday morning. The Adjunct General acknowledged the recent loss of Staff Sgt. Edgar Brian Torres-Tovar and Staff Sgt. William Nathanial Howard in Syria and emphasized the integral role the Iowa National Guard plays in national defense and global security. Osborn forecasted transformation and modernization, specifically as technology and artificial intelligence advances, and the Guard is launching new units and constructing new facilities to tackle cyber defense issues.

Iowa Legislative Workflow

Scheduled for 100 days, the second year of each General Assembly (even years) is shorter than the first year, meaning a slightly expedited legislative timeline and less time between the deadlines established in the Iowa Code and in chamber rules. The entire House of Representatives and half of the Senate is up for election, meaning the shorter session allows for more time to campaign after adjournment. These time limits have not slowed bill introductions as lawmakers got straight to work, introducing 177 bills in the House and 109 bills in the Senate after a record-breaking number of bill introductions last year.

The legislature will observe the Martin Luther King Jr. holiday on Monday, January 19, and will gavel back in for week two on Tuesday, January 20. The full 2026 Session Timetable is here.