Week 7 brought the first significant floor action of the session, with full debate calendars in both the House and Senate. In total, the House debated and approved 45 bills this week, which will now go to the Senate; the Senate debated and approved 24 bills, which will now go to the House; the majority of these bills were approved unanimously with bipartisan support. The weeks between funnels are largely consumed with floor work, as chambers work to approve their priorities so they may be considered by the opposite chamber.

Education is the predominant topic of conversation at the Capitol. Of note this week, the House approved their version of the Supplemental State Aid SSA (HF2613) which sets the growth rate for school aid for the FY 2024-2025 school year on a largely party-line vote (60-36). HF 2613 as passed sets the annual increase to 3%, a number higher than the Governor’s and Senate’s version of the legislation. Under a 3% increase, the state would fund Iowa school districts at a rate of $7,864 per pupil in the 2025-2026 school year, an increase from $7,635 for the current school year.

Legislative Services Agency (LSA) estimates that total state school aid for the year aid will be $3.814 billion, an increase of $146.7 million (4%) over FY 2024.

- $129.1 million in property tax replacement funding, an increase of $14.3 million/12.5%.

- $627.1 million for categorical supplements, an increase of $34.4 million/5.8%, split between $355.2 million for the teacher salaries, $40.3 million for professional development, $41.5 million for early intervention and $190.1 million for the TLC supplement.

- $91.9 million for preschool funding, an increase of $1.6 million/1.81%.

- $10.9 million in budget adjustment funding for 116 qualifying districts (101% budget guarantee, an increase of $5.4 million/99. 7%.

Lawmakers missed their deadline to pass the SSA earlier in February, with leadership citing that the delay was in part due to all of the other pieces of legislation with education components at play.

The House bill now moves to the Senate for their consideration; the Senate Education Committee has passed a shell SSA bill (SF2258), so no further committee action is needed—the Senate can amend their version of the bill on the floor.

In addition to their work on the SSA bill, the House held a public hearing on their latest version of the House Area Education Agencies (AEA) Plan [1] (HF2612). The House plan differs from the plan proposed by the Governor and the plan approved in Senate Education last week. HF 2612 gives the DOE supervision over the AEAs but at least initially will ensure more special education funding stays with the AEAs. The House bill also calls for a task force to study AEAs and special education, with recommendations due by December 2024. Both opponents and supporters of the bill flooded the Capitol on Wednesday evening to attend the public hearing.

Legislative Activity

State Government

RFRA

One of the longest debates this week was over SF 2095, the state version of the federal Religious Freedom Restoration Act (RFRA). The debate demonstrated opposing perspectives on the bill passed in 25 other states. Republican floor manager Senator Schultz said the bill proposes a higher legal standard for situations where a person or entity claims that government action has restricted their exercise of religion. It requires the use of the compelling interest test if a person takes the issue to court, and provides that the government must use the least restrictive means to regulate the religious practice.

Senator Weiner (D) introduced an amendment clarifying that RFRA provisions cannot be applied above protections against discrimination, citing violations in other states. Senate Democrats expressed concern that RFRA has the potential to be pitted against the Iowa Civil Rights Act, the Americans with Disabilities Act, and laws protecting against child labor abuse, and that it could be used to justify housing discrimination or deny access to medical care. These concerns echo a nationwide debate about religious and personal freedoms at the state level since the federal RFRA does not apply to states.

The Senate passed the bill 31-16 on Tuesday; the House did not take up the companion HF 2454 this week.

Gender balance on boards and commissions

After a lengthy caucus, Senators debated legislation to remove the gender balance requirement for Iowa’s state boards and commissions. SF 2096 removes the requirement that state panels appoint an equal number of men and women. Supporters, including several Republican women, spoke in favor of the legislation, stating that it is an antiquated bill and women do not need a quota for their qualifications to be recognized. Democrats said the challenges faced by Iowa women have not disappeared, and many more men than women still serve on state boards.

Under current law, boards, and commissions are allowed to select any candidate if they are unable to find a qualified candidate that meets the gender-balance rule after a 90-day search. In 2012, the balance requirement was extended to cities and counties, and with it the percentage of Iowa municipalities with gender-balanced boards rose from 13% to 61% and rose from 12% to 62% for counties.

Democratic Senator Quirmbach voted with Republicans and the bill passed the Senate 32-15. The companion bill HF 2540 is on the House debate calendar but has not been taken up.

Foreign Land Ownership

SF 2204 is a bill from the Governor that intends to protect Iowa farms from ownership by foreign entities. The legislation adds registration and reporting requirements with the Secretary of State and gives enforcement powers to the Attorney General. The bill passed the Senate unanimously on Monday. The House companion (HF 2483) passed the funnel and had an amendment filed this week, adding a toll-free number for people to report violations to the Attorney General’s office.

Gov. Kim Reynolds issued the following statement in response to the Iowa Senate passing SF 2204:

Iowa plays a major role in feeding and fueling the world, and it is important we maintain our dominance as the leading agriculture powerhouse. But as threats of foreign ownership of land adapt, so should our laws. American soil should remain in American hands. I am pleased that the Senate has passed my bill providing greater protections for Iowa farmland and increased penalties for foreign owners that don’t comply with our laws.

State Agency Audits

A bill allowing private accounting firms to conduct annual audits for state agencies passed the Senate on Monday. Currently, the State Auditor’s office conducts these audits, but SF 2311 would remove that requirement and allow the state agencies to choose through a competitive bid process. Iowa State Auditor Rob Sand, the only Democrat currently holding elected statewide office, and Senate Democrats opposed the legislation, stating that the bill would decrease government accountability and is personally aimed at Sand. Republican floor manager Senator Bousselot said the legislation would allow the flexibility that Iowa local governments currently enjoy and would keep the yearly financial audit timely and cost-effective.

The bill passed the Senate 31-16 and was sent to the House, where it will need to move through the committee process before it is floor-eligible.

Health and Human Services

Maternal Care

SF 2251 extends postpartum Medicaid coverage for new mothers from 60 days to 12 months and decreases the income eligibility requirements to families at or below 215% of the federal poverty line, from the current 375%. Several Democrats voted for the bill (Giddens, Trone-Garriott, and Wahls) praising the expansion of post-partum services to one year but wanted the bill to keep the current income eligibility and not remove low-income women from Medicaid.

This legislation is a priority of Governor Reynolds this session. She released a statement when it passed the Senate 34-13:

Building a culture of life in Iowa means getting families off to the right start, but two months of postpartum care isn’t enough,” Reynolds said. “Extending postpartum care to 12 months for women with the greatest need helps them recover from childbirth, access family planning services, manage chronic health issues, and address mental health. For our state to be strong, our families must be strong.

The Legislative Services Agency’s fiscal note estimated that 1,300 women and 400 infants would lose Medicaid coverage per month under the new bill. The bill would also move roughly 1,100 infants each month from Medicaid to HAWKI, the state children’s health insurance program, who are between 215% and 302% of the federal poverty level.

MOMS Program

SF 2252 would give the Iowa Department of Health and Human Services the power to oversee the MOMS program, removing the previous requirement to hire a third-party administrator. The state was unable to find a qualified administrator through the RFP process last year, meaning the Department was already providing this oversight.

Several amendments were proposed by Democrats but denied by the full chamber, including requiring MOMS providers to follow medical privacy standards and advertise that they are not licensed healthcare providers. The Senate passed SF 2252 on a 31-16 vote. The House companion HF 2267 is currently debate-eligible.

Ways and Means

Income Tax

The Governor’s individual income tax cut bill (SSB 3038) received initial approval from a Senate subcommittee this week. The bill would reduce Iowa’s 5.7% individual income tax rate to 3.65% in 2024, with another reduction to 3.5% in 2025. Republicans plan to utilize the $902 million in reserve funds and $2.74 billion in the Taxpayer Relief Fund as reasons to reduce income tax collection.

As originally drafted, the Governor’s bill included seven divisions:

- Combines the Cash Reserve Fund and Economic Emergency Fund into one fund.

- Accelerates the reduction in individual income tax rates.

- Establishes a penalty for over-withholding.

- Raises the threshold for requiring estimated tax.

- Eliminates the income tax liability on lump-sum distribution of retirement income.

- Treats childcare facilities as a residential classification for property tax purposes.

- Makes changes to the unemployment insurance tables and rates paid by businesses.

The Senate Ways and Means Committee amended the bill on Thursday, stripping the bill in its entirety except for Division II, which accelerates the reduction of individual income tax rates. The other divisions of the bill may be introduced independently or amended into similar legislation.

Senator Dan Dawson, Chair of the Ways and Means Committee, mentioned in the Committee that the other tax proposals could move forward this year. Tax bills are not subject to the funnel because they are assigned to Ways and Means.

Retirement Tracker

Representative Sharon Steckman, a Democrat from the Mason City area, announced her retirement this week. She has served in the legislature for eight terms. Steckman currently serves as Ranking Member on the House Education committee and sits on the State Government, Environmental Protection, and Natural Resources committees.

What’s next?

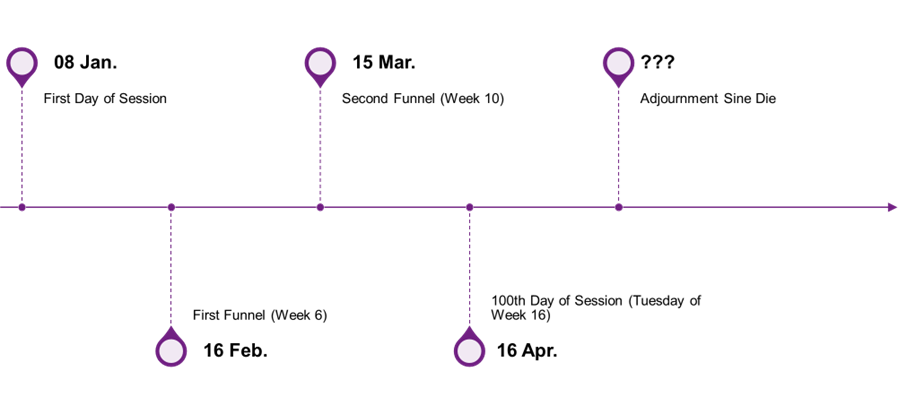

The focus of the next few weeks will be advancing bills through the full chambers so they can be assigned and considered in the opposite chamber before the second funnel on March 15. Floor debate will consume the next few weeks. We can also expect continued discussions on education matters, including an agreed upon SSA appropriation to be sent to the Governor and continued negotiations over AEA matters; additionally, deliberations on the income tax reform will begin in earnest between the chambers and the Governor. As we approach the March REC we can expect preliminary conversations related to the development of the FY 2025 budget to begin.

The full 2024 Session Timetable can be found here.